VATRE

Page Navigation

- 2023 VATRE Proposition A Information

- VATRE Prop A Frequently Asked Questions

- VATRE Prop A Teacher Pay Scale

- Important VATRE Prop A Dates

- VATRE Prop A in the News

- VATRE Prop A Videos

- VATRE Prop A Print Materials

- VATRE Prop A on Social Media

- VATRE Prop A Ballot Language

- VATRE Prop A Voting Information (Early Voting)

- VATRE Prop A Voting Information

- VATRE Prop A Election Results

- VATRE Prop A Staff Ethics and Guidelines

- Efficiency Audit

VATRE and Texas Public School Funding

-

What is a VATRE?

VATRE stands for Voter Approval Tax Rate Election. It is an election allowed by the State Legislature to approve a tax rate increase that generates additional revenue for public schools.

If a school district adopts a maintenance & operations (M&O) tax rate that exceeds the maximum amount allowed by state statute, a VATRE must be held to gain voter approval to raise the tax rate. For Fort Bend ISD a tax rate that exceeds $0.9492 triggers a VATRE.

-

What happens if the VATRE does not pass?

FBISD adopted a balanced budget for the 2023-24 school year after making $40 million in reductions over the last two years. These reductions were carefully planned to avoid increasing classroom sizes or impacting student programs of choice. However, even with the reductions, FBISD could not afford to include raises for teachers and other staff in the budget or to fully fund having armed personnel at all campuses, as is now mandated by House Bill 3.

FBISD is one of the very few districts that did not provide raises in the current school year. Many districts in the area approved a 3% increase for teachers and staff, with some adopting deficit budgets to afford the raises. If the VATRE is not successful FBISD will not be able to give raises to teachers or other staff who support students this year and will have to make further reductions to add armed security personnel to be in compliance with HB3. Also, the District will not be able to implement the differentiated teacher pay scale. Our inability to give raises will likely result in a significant loss of teachers, police officers, classroom aids, bus drivers and district staff to other districts and industry.

For the 2024-25 school year, the District will have to adopt a deficit budget to afford raises, or make additional reductions. Without raises this year, expenditure reductions for 2024-25 will need to be significant to increase pay for teachers and staff. This will likely impact programs of choice, class sizes, planning time, school consolidations and less support staff for campuses.

Also, the district’s bond ratings and state financial ratings may decrease, which would cause higher interest rates when FBISD issues debt. The district would likely propose a VATRE to voters again in November of 2024 (they can only be placed on November ballots).

A successful VATRE will allow us to compensate teachers and other staff, as well as add armed security personnel at all campuses while avoiding reductions that may impact classroom sizes or student programs of choice. -

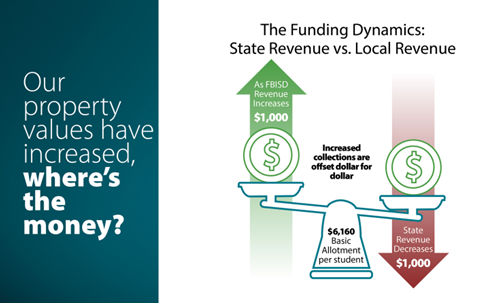

Isn’t the school district receiving a windfall from property taxes?

No, property appraisals have increased by 10% within the district, but the increase in funding to the district’s General Fund because of increased property values is $0.

That’s because when local tax revenues increase, the state decreases the amount of school funding it sends to districts – cancelling the gains. Increases in revenue only come from more enrollment, higher attendance, or with the addition of more enrichment pennies to the tax rate. The VATRE adds enrichment pennies and provides more recurring revenue for FBISD.

-

Explain how “pennies” work and how many will be in the VATRE.

There are two types of “pennies” – Golden and Copper, which are used to generate additional funding for school districts. They are called “enrichment” pennies since the state considers them to be above what a school district needs to offer basic educational services. Golden pennies are worth more than Copper ones.

FBISD’s VATRE includes 4 pennies/cents. Two are Golden and two are Copper. The district could ask for as many as 11 cents but at 4 cents, FBISD’s tax rate will be 14.5 cents lower than the rate last year.

Golden pennies generate funding for the district from two sources- local tax collections and increased state funding. If voters approve the VATRE, the district will receive $25 million from its two golden pennies, of which $14 million would be from the state. Each Copper penny will generate about $5.5 million, which will come solely from local tax collections. For each copper penny, based on property values and enrollment, FBISD would pay the state $500,000 in recapture, making the total recapture amount $1 million per year ($500,000 x 2 copper pennies). The net result will be $10M in new funding for the district from the 2 copper pennies. The total amount in new funding the district would receive if voters approve the VATRE is $35 million. -

How many pennies will be in the VATRE?

While the district could have asked for 11 pennies based on State funding formulas, the FBISD board adopted a tax rate of $0.9892, which is 4 pennies higher than the prescribed rate mandated by the State but is still 14.5 pennies less than last year's tax rate.

-

Why 4 cents/pennies, and not more?

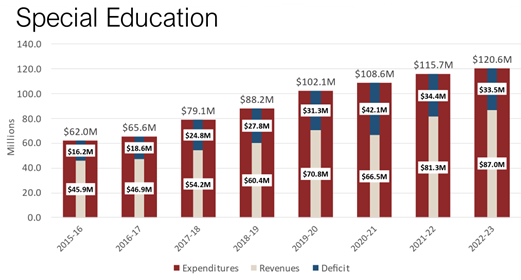

We want to continue to have a low tax rate compared to our peers, and only ask for what we truly need. The four pennies address our most essential needs (teacher pay, staff pay and providing armed security guards at elementary campuses). While special education is critical, and with more growth, the special education deficit is expected to expand, we are hopeful that the State will address funding for special education in the special session.

-

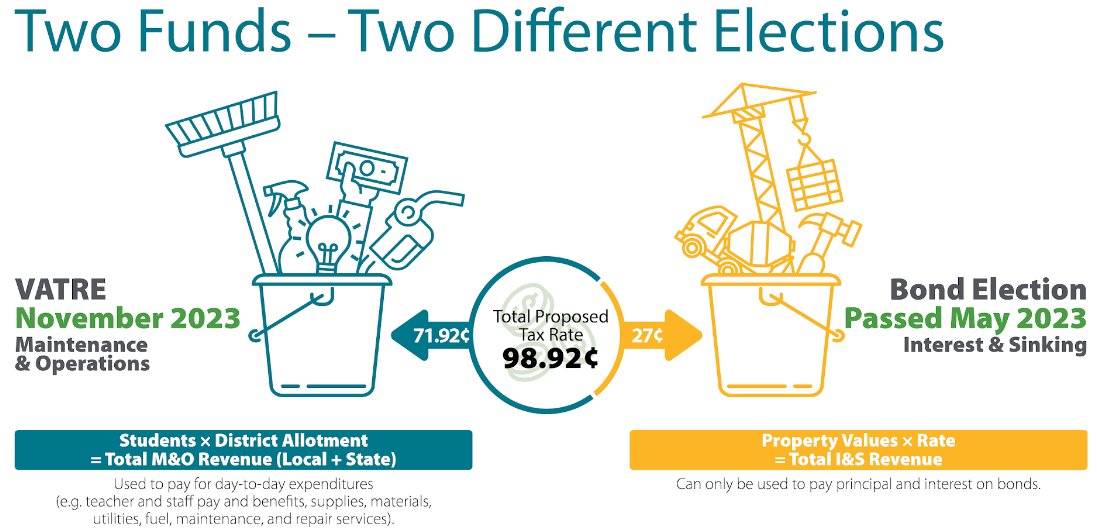

What is the difference between M&O and I&S tax rates?

Taxpayers support public education through their property taxes.

The Maintenance and Operations (M&O) tax rate supports day-to-day operations for the district, including teacher salaries, utilities, transportation expenses, etc.

The Interest and Sinking (I&S) tax rate is used to pay back funds the district has borrowed to build new schools, do major renovations, etc. The I&S fund is also called the Debt Service fund since the money can only be used to pay off debt and not for day-to-day operations like salaries.

On homeowners’ property tax bills the total rate is listed, not the two separate rates.

-

What about the State? Didn’t they increase funding this year? What has the State done so far?

After FBISD voters approved the 2023 Bond this past May, administration and the board were united in not wanting to have another election any time soon. We were also optimistic that the State would increase the basic allotment, address funding discrepancies for special education, and ensure teachers are well compensated, given the state’s $33B+ surplus. We were particularly optimistic about teacher compensation since the top recommendation of the teacher vacancy study ordered by Governor Abbott was increasing teacher compensation. In fact, at the end of June, we heard from one of our representatives who expressed optimism that a teacher pay increase for both years of the biennium would be included in the special session bill that would be passed. Unfortunately, teacher pay was not included in the final legislation that was passed, and there is no indication of when (or if) a future special session will address this critical issue.

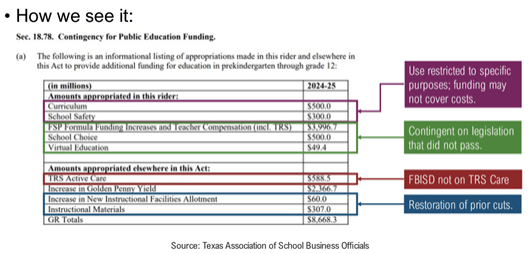

Recently, an elected state official mentioned to us the state had invested almost $8.7B into public education. Our team is faced with the reality of how it affects us. The table below shows the list of those investments and the only one used by FBISD as part of our budget for next year:

The only increase in State aid for school districts that can be used for salary increases was the increase in the golden penny yield. This generated almost $17M for FBISD. This new revenue has enabled FBISD to have a balanced budget with 90 days of fund balance. This increase also allowed the district to use our remaining ESSER funds for a one-time retention supplement of $1,500 for teachers and $1,000 for other employees. While this helps, it is far less than neighboring districts have offered (i.e., HISD at $10,000). However, the supplement is not an ongoing raise and does not address our competitive ranking in the region. This is especially troublesome when the budget that was adopted by the State included a 5% increase for all State employees for both years of the biennium (including a minimum increase of $3,000). -

What about the Special Session?

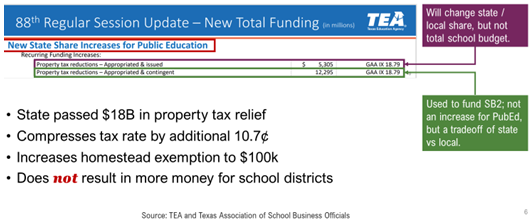

As was widely reported throughout the State, the special sessions focused on property tax relief. The following slide from TEA shows the breakout of the $17.6B appropriated and issued for the property tax compression in law from 2019 and the rest that is contingent on voter approval this November. It is important for our public to realize that TEA is communicating the $17.6B as “New State Share Increases for Public Education.” While this is factual, it is misleading to the average taxpayer. These investments do not result in any new money for school districts.

The state-wide increase in the value of the golden pennies ($2.4B) accounts for only 9% of the total funding allocated by the State for public schools. $8.7B was outlined in Sec. 18.78. Contingency for Public School Funding, and $17.6B for property tax relief that TEA has labeled as new State share increases for public education.

Finally, this is critical, even if the State does take action to increase school funding in a special session later this fall or early next year, the raises for teachers will be mandated, and all districts will increase teacher pay at the same level. Thus, our $3000 gap in starting teacher pay will remain, and without a successful VATRE, we face the possibility of losing hundreds of teachers to neighboring districts.

VATRE Prop A - Increase Pay to Recruit & Retain High Quality Teachers and Staff

-

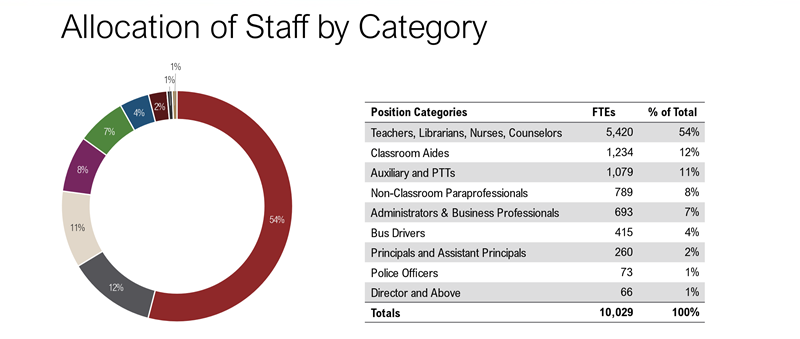

How will the raises be allocated among employees if the VATRE is successful?

-

Why was FBISD not able to include raises in the budget this year?

Projected student enrollment growth has slowed, inflation has impacted expenditures, increased staffing for Special Education students has been required, innovative academic programs dating back to 2017 have been added, low utilization of campuses, and expiration of government funding received during the pandemic have all contributed to the current financial situation. Additionally, FBISD has historically maintained a low tax rate and has fewer enrichment pennies than peer districts.

Additional information about some of the key causes:

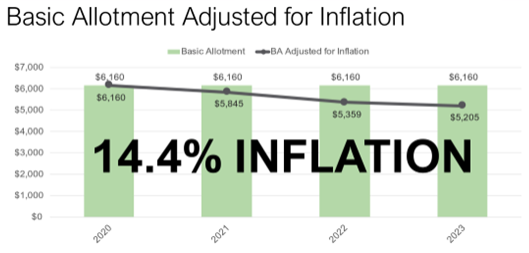

Inflation

Like all families and businesses, FBISD is paying more for fuel, utilities, food, supplies, and labor. Between inflation and the national shortage of labor, all employers must pay more to attract and retain talent.

The basic allotment that school districts receive based on enrollment and attendance has not been adjusted to keep up with inflation. The allotment has not been adjusted since 2019, and would need to be increased by $887 (14.4%) to keep up with inflation. That adjustment did not occur during the legislative session, in spite of a historic state budgetary surplus of $30+ billion.

Increased Staff for Special Education:

The District has added 5,146 special education students since 2016. Recent growth in the number of students with special needs has highlighted the inadequate state funding for special education. The District had 9,821 special education students at the end of 2023. The difference between the average cost per student and the average revenue from the state is $3,450 per student per year, therefore the total amount being absorbed by the district as it provides services for Special Education students was $33.5 million last year. The Special Education deficit was $16.2M in 2016:

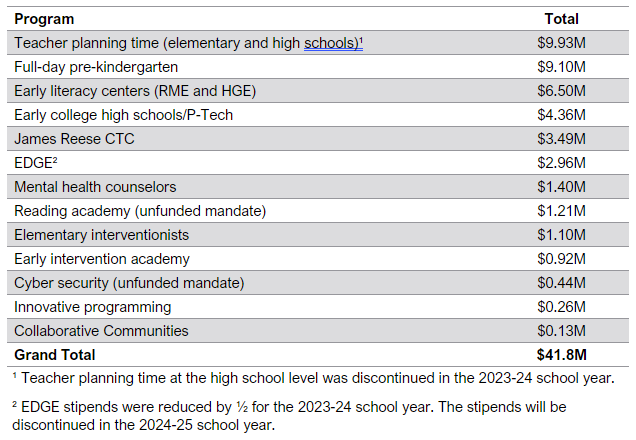

Innovative Academic Programming

Since 2017-18, the District added enrichment programs such as the Early College High School at Marshall High School, P-Tech programs at Hightower and Willowridge High Schools, opened the James Reese Career and Technology Center, to name a few, without increasing taxes.

Low Campus Utilization

The fixed costs associated with maintaining smaller neighborhood schools make it very difficult to allocate more funding for teacher pay or other District needs. Each campus, regardless of enrollment, requires a principal, assistant principal, nurse, counselor, custodians, and other positions that cost roughly $1.4 million.

For the 2023-24 school year, the District has consolidated four campuses into two this year as part of the recent budget cuts. More consolidation is needed and the topic will be part the District’s strategic planning process that will start later this fall. -

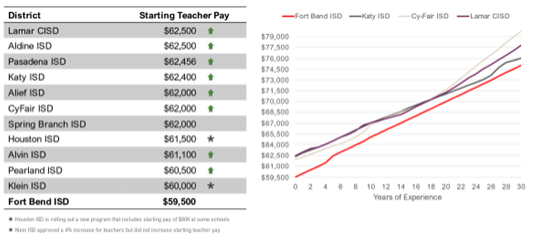

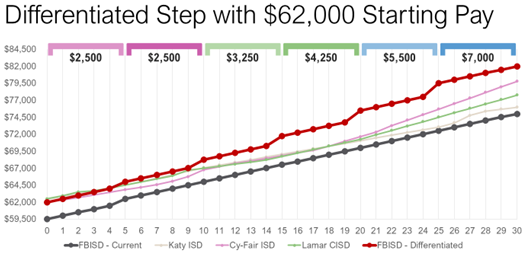

How do FBISD raises compare to neighboring districts?

Fort Bend ISD did not offer ongoing staff raises for the 2023-24 school year. A one-time retention supplement of $1,500 for teachers and $1,000 for all other staff was offered, but will not occur in 2024-25. Teachers also received a $500 step increase that occurs annually as part of the teacher step scale based on years of experience.

The District must maintain a competitive compensation package to retain and attract teachers and staff. Having the revenue from the VATRE will allow competitive compensation increases to happen.

Raises over the last three years have not allowed FBISD to keep up with neighboring districts. FBISD gave the following raises over the last three years:- FY2021-22: 6% for teachers; 4% for non-teaching staff ($36 million).

- FY2022-23: 2% for teachers; 2% for non-teaching staff ($14.5 million).

- FY2023-24: $500 step for teachers, no raises for non-teaching staff ($2.7 million).

Even with these increases in salaries, the starting pay for FBISD is $3,000 below our peers.

-

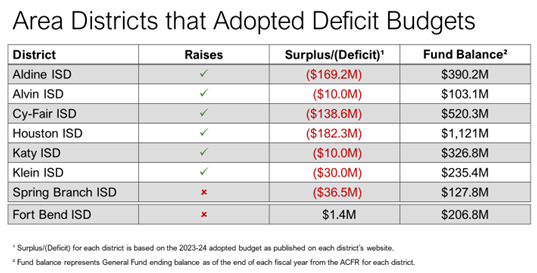

How have other districts been able to afford raises, but FBISD is not able to?

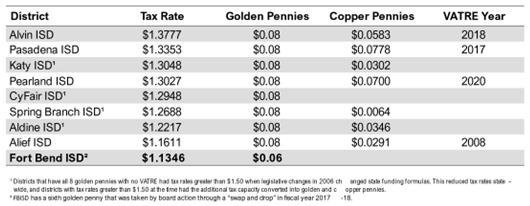

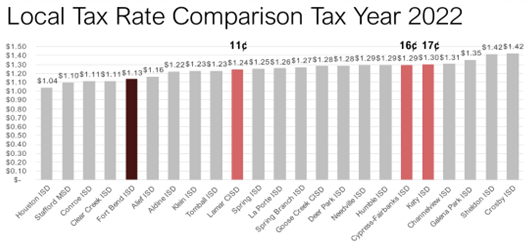

As mentioned earlier, FBISD has maintained a low tax rate and has fewer enrichment pennies in the tax rate than our peer districts (see table below).

Eight districts in the region have all 8 golden pennies that are allowed by state statute. Seven of the eight districts also have copper pennies (Cy-Fair is the only one without copper pennies).

The value of the 2 golden pennies for FBISD is $25M, and the value of two copper pennies is $10M per year.

Additionally, several districts adopted deficit budgets to help fund salary increases:

-

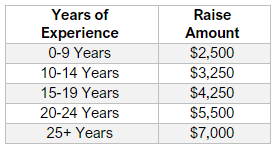

What is the differentiated teacher step plan?

Prior to the VATRE, Fort Bend ISD’s P7 Teacher Salary Structure (187/190 calendar) provided a $500 pay increase incrementally each year except for a one-time increase of $1,000 after the completion of Year 5 (Step 6).

The 2023-24 P7 Teacher Salary Structure (187/190 calendar) included in the VATRE expands the differentiation factor to each 5-year milestone up to 25 Completed Years of Service (Step 26).

Teachers on P7 Teacher Salary Structure with different calendar days are paid using the daily rate of this scale.

VATRE Prop A - Fund State Safety Mandate for Additional Security Personnel

-

Why is $2.5M needed for Safety and Security?

The state has mandated the District to have armed personnel at each campus. This mandate is not fully funded. FBISD’s current plan is to contract with armed security firms. This will have an annual cost of $2.5M. If the district is not successful with the election, additional cost savings will have to be identified to fund the new expense. There is a shortage of police officers across the State and the increase in police pay from the VATRE should enable the district to hire more officers and replace the armed security guards over time.

-

Why hire armed security guards instead of bringing in guardians, marshals, or our own police officers?

School districts have several options for obtaining security services at school facilities. School districts weigh these options based on factors such as district need, size, cost, and roles and responsibilities. Fort Bend ISD is now legislatively required to ensure that every campus has an armed person at each campus during regular school hours. Fort Bend ISD already employs its own school district police department with 76 sworn police officers. Those officers are assigned to all secondary campuses, elementary patrol, investigations, and administrative functions. With the new legislation, Fort Bend ISD must hire fifty (50) armed personnel to be in compliance. The VATRE in November 2022 included $4M to add police officers at each elementary school. Unfortunately, the election was not successful.

Security personnel options include giving local authorization for selected staff to carry a firearm on campus (more commonly referred to as the guardian program), school marshals, uniformed private security, or additional FBISD Police Officers.

The District desires to have a well-trained, uniformed presence on campus as opposed to a plain clothes civilian. Uniformed private security, or police officers, also allow the security personnel to focus entirely on the security of their assigned campus as opposed to having overlapping roles and responsibilities such as a teacher, coach, or administrator. The uniformed presence allows for immediate recognition by students, staff and visitors who may need assistance as well as providing an immediate visual deterrence for a person who may pose a threat. Recognizing there is a nationwide shortage of police officers, the District will contract with private security companies to provide personnel who are armed, trained, and credentialed by the Texas Commission on Law Enforcement until such time as the District can staff each campus with a Fort Bend ISD Police Officer. Our current pay for police officers is not enough to fill existing vacancies. Once salaries are increased to be competitive with neighboring districts and other law enforcement agencies, the goal is to begin replacing the armed security guards with district police officers.

VATRE and Whether It Impacts You

-

Aren’t the city and county also raising their taxes?

Actually no, they are not. Please see the table below. The county is reducing their tax rate. All of the cities in the table below are reducing their taxes. Only the City of Sugar Land is increasing their taxes, but it is about a third of penny. This increase is being offset by the City increasing their optional homestead exemption up to 15% of valuation. Please see the table below:

Tax Rate

ARCOLA

MISSOURI CITY

RICHMOND

MEADOWS PLACE

SUGAR LAND*

Change in City

-0.0305

-0.0029

-0.0100

-0.0064

0.0035

Change in FB County

-0.0118

-0.0118

-0.0118

-0.0118

-0.0118

Change if FBISD Successful VATRE

-0.1450

-0.1450

-0.1450

-0.1450

-0.1450

Total Change

-0.1873

-0.1597

-0.1668

-0.1632

-0.1533

Homestead Exemption increasing from $40,000 to $100,000

*Optional Homestead Exemption increasing to 15% of valuation as partial offset of small tax rate increase.

Also, multiple county officials have stated publicly that the county will increase the county tax rate if their bond passes.

-

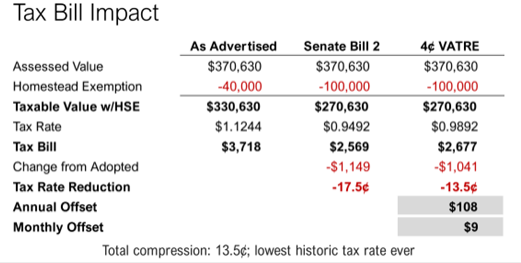

What’s the difference in tax bills if the VATRE passes?

The district’s current tax rate is $1.1346 for every $100 of valuation. The rate would have been $1.1244 for the upcoming tax year due to legislatively mandated tax rate compression, but the state legislature had a special session that increased the homestead exemption to $100,000 and added additional tax rate compression. The increase in the homestead exemption and the additional compression must be approved by voters in November but is expected to pass.

The new tax rate, based on the special session, is $0.9492 for every $100 of valuation. This rate results in a tax bill of $2,569 per year for the average taxpayer with a home valued at $307,630.

If the District’s VATRE is successful, the tax rate will be $0.9892¢ for every $100 of property valuation. That’s $2,677 per year for the average taxpayer.

The difference is $108 per year, or $9 per month. With either tax rate, because of state mandated tax rate compression and the increase in the homestead exemption, the average taxpayer will still see a decrease of over $1,000 in their tax bill.

The table below spells it out when compared to the tax rate used for the budget adoption:

-

Will there be a difference in my tax bill with a VATRE?

If the VATRE is successful, the tax rate will be $0.9892 ($0.145 less than last year) for every $100 of property valuation. That’s $989 per year or $82 per month per $100,000 of valuation.

If the VATRE is not successful, the tax rate will be $0.9492 for every $100 of property valuation. That’s $949 per year or $79 per month per $100,000 of valuation.

So, the difference in taxes with the VATRE will be $3 per month for every $100,000 of valuation. -

I have rental property. How will the VATRE affect the tax bill on my rental property?

Property that does not have a residential homestead exemption will still benefit from the state mandated compression of the tax rate.

Based on the average home valuation of $370,63, the tax bill of a property without a homestead exemption at a tax rate of $0.9492 for every $100 of valuation would be $3,518. This is $649 less than the bill would have been prior to SB2 going into effect.

If the District’s VATRE is successful, the tax rate will be $0.9892 for every $100 of property valuation and the tax bill will be $3,666, or $501 less than the bill would have been prior to SB2 going into effect.

FBISD Finances

-

The District just passed a bond for $1.26B? Why is more money needed?

By law, bond funds CANNOT be used for teacher pay, staff pay or security guards.

-

What will the new revenue be used for?

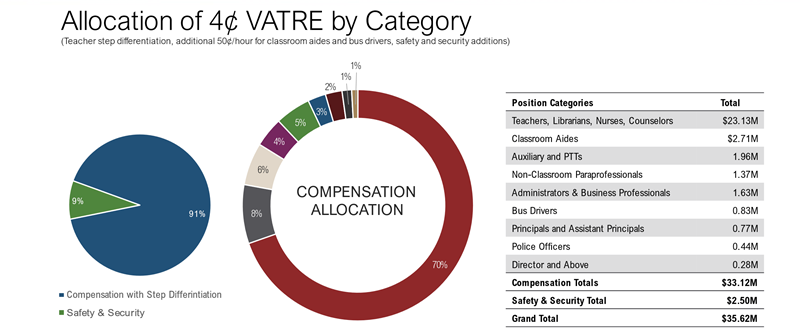

Voter approval of a tax rate of $0.9892 ($0.145 less than last year) will generate more than $35 million in additional revenue. The District is planning to use this additional revenue for:

- Compensation ($33.1M)

- Increase teacher pay to $62,000

- Differentiated teacher step scale at five-year milestones

- Increase police officer pay $5,742

- $1.50/hour increase for:

- Classroom aides

- Bus drivers

- $1/hour increase for:

- Auxiliary staff

- Non-classroom paras

- 3% increase for:

- Administrators and business professionals

- Principals and assistant principals

- Directors and above

- Safety and Security ($2.5M)

- Armed security personnel at all elementary schools

The differentiated teacher step scale is below. This will reward teachers with more experience and will hopefully improve teacher retention and recruitment. With the national teacher shortage, improving teacher retention will be essential.

Based on experience the teacher raises will be:

- Compensation ($33.1M)

-

How does FBISD’s revenue compare to other districts?

As part of the VATRE process, school districts are required to conduct an Efficiency Audit. The district’s financial auditor, Whitley Penn completed the required Efficiency Audit and it is available here.

According to the efficiency audit, FBISD revenue was $10,830 per student. This was $1,674 LESS per student than the average for districts across the state. It is also $1,068 less per student than the peer districts reviewed by Whitley Penn for the study. Based on the district’s current projections of enrollment and the impact of the VATRE, a successful election will increase the revenue per student by $438 and will bring FBISD more in line with the state and peer district averages. -

What are options to increase revenue?

District revenue only increases if there is more enrollment, higher attendance, an increase in the basic allotment from the state, or with a higher Maintenance & Operations tax rate. District administration is working hard to increase enrollment and improve attendance. These efforts are paying off now that current enrollment is at 80,000. We still do not know if the State will increase the basic allotment even though they had a record surplus this past legislative session.

That leaves the only other option provided by the State: to have voters approve enrichment pennies through a Voter Approval Tax Rate Election (VATRE). -

What has FBISD done to reduce expenses?

The district reduced spending by $16 million as of June 2022, and an additional $24.6M as of June 2023, and efforts to reduce expenses continue. These ongoing efforts include:

- Reviewing all positions to continue achieving staff reductions through attrition.

- Scrutinizing funding for certain programs to better evaluate the costs and affordability compared to the value.

- Analyzing how to streamline underutilized campuses.

- Hiring an outside firm to conduct a Cost Savings Audit.

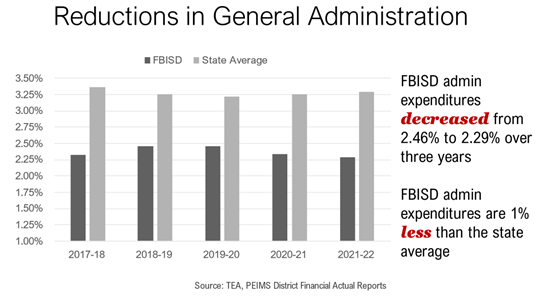

Some of the reductions have been in General Administration:

The 0.17% decrease in General Administration between 2019-20 and 2021-22 represents a reduction of $1.46 million in expenditures. The district will continue to make reductions in General Administration through automation improvements in Finance and Human Resources. -

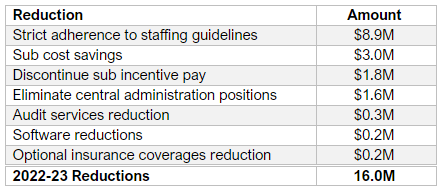

What does $40 million in reduced FBISD spending look like?

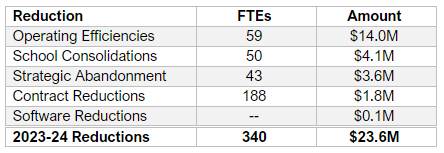

Over the last two years, the district has reduced expenditures by $40M. This includes $16.0M in 2022-23 and an additional $23.6M for the 2023-24 school year.

Reductions made in 2022-23 included:

Reductions made for the 2023-24 school year include:

Operating efficiencies ($14.0M) include: Closure of the administration annex; reconfiguration of academy bus routes; funding band instruments from bond proceeds; insourcing custodian services at the James Reese CTC; discontinuation of nursing agency contract; adjusting CTE contract days, redirecting English Learner Specialists to the classroom; adjusting the staffing model for math specialists; elimination of 58 central administration positions; strict adherence to staffing guidelines at campuses; et al.

School Consolidations ($4.1M) include: Consolidation of Mission Bend and Mission Glen elementary schools into Mission Glen while Mission Bend is rebuilt. When the new campus at Mission Bend reopens, Mission Glen will be permanently closed. Consolidation of Briargate and Blue Ridge elementary schools into Blue Ridge while Briargate is rebuilt. When the new campus at Briargate reopens, Blue Ridge will be permanently closed. Consolidation of Barrington Place into Lakeview and Meadows Place elementary schools while the campus is renovated. Barrington Place will reopen in the 2024-25 school year.

Strategic Abandonment ($3.6M) includes: Closing the teacher center; elimination of the ropes course; and elimination of three stipends.

Contract Reductions ($1.8M) include: Insourcing the energy management program; changing graduation venues; and matching the color copy clicks to actual usage.

Software Reductions ($0.1M) include: changing vendors for material safety data sheets and eliminating two software programs.

-

How does FBISD’s tax rate compare to other districts?

At $1.13, FBISD’s tax rate is lower than the present rate in Lamar CISD ($1.24) and Katy ISD ($1.29). FBISD has historically maintained a low tax rate in comparison to neighboring districts.

-

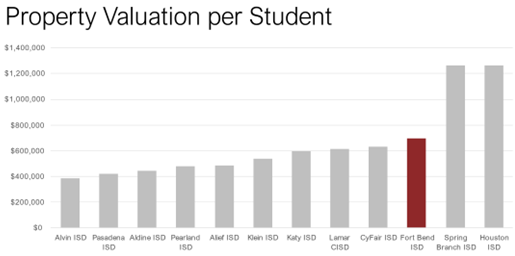

Isn’t the District’s lower tax rate only because it has higher property value per student?

Please see the table below:

Generally, the trend fits the narrative that higher values equal lower tax rates. However, there are exceptions and other interesting notes:

- Spring Branch ISD’s value far exceeds FBISD’s value per student AND their tax rate is 12 pennies higher

- Alief ISD has much lower property value than FBISD, but FBISD’s tax rate is only 3 pennies lower than Alief’s

- CyFair, Katy and Lamar are not that much lower than FBISD in value per student, but their tax rates are significantly higher

So much goes into the make-up of the tax rate including:

- Number of enrichment pennies – FBISD has fewer than others as noted elsewhere in this FAQ. However, Lamar CISD has three less than FBISD, but a much higher tax rate.

- Active bond programs and debt management

- Tax rate management – FBISD has lowered the debt service rate by six pennies since 2017. That is very unusual. Most districts with active bond programs have kept their debt rates the same so make it easier to pass future bonds.

FBISD has an active debt management program that saves taxpayers money. The current finance team implemented strong debt management practices that are still in place. These include:

- In 2016, we started the tax-exempt commercial paper program (TECP) that has saved over $24M through interest cost avoidance through June 2023.

- In 2014, we started the use of variable rate debt to take advantage of the lower end of the yield curve and to help manage the tax rate. The impact of this change in philosophy has not been quantified, but we believe it to be more than the savings from the TECP program.

- Since 2014, we conducted multiple refundings of debt on a “current” basis that has saved the district more than $108M since 2014.

- In 2014, we implemented the calculation and execution of keeping average new debt maturity well below the average useful life of bond funded assets. This means we are not paying for assets with short-term life with long-term debt.

-

Will a successful VATRE trigger hefty recapture payments for FBISD?

No. Compared to what FBISD will gain, the VATRE will not trigger hefty recapture payments. Fort Bend ISD is asking voters to approve 4 pennies in its November VATRE. Two of the pennies are golden – which are not subject to recapture – and 2 are copper – which are subject to recapture.

Golden pennies are so named because the state gives the district revenue for each of them. Adding two golden pennies with a successful VATRE will increase what the state pays FBISD by $14 million per year – which contributes to the $35 million the VATRE would provide overall.

For each copper penny, based on property values and enrollment, FBISD would pay the state $500,000 in recapture, making the total recapture amount $1 million per year ($500,000 × 2 copper pennies).

Therefore, the net impact of a successful VATRE is $13 million more in revenue for FBISD from the state. ($14 million from the golden pennies -minus- $1 million in recapture from the copper pennies = $13 million)

The $35 million a successful VATRE would provide is the net amount FBISD would receive after the recapture requirement is met.

Recapture is not permanent. If enrollment continues to increase but growth in property values slows down, then FBISD would exit recapture. Additionally, if the state legislature increases the basic allotment, that would also help the district exit recapture. -

Does Fort Bend ISD have its financial statements audited by an external firm?

Yes. The district is required to have a financial audit performed each year by an outside audit firm. Whitley Penn is the firm selected by the Board of Trustees to audit Fort Bend ISD's financial statements and information on an annual basis.

The District has always received an “unqualified” rating from its external auditor, which is the highest available opinion and means the auditor found that the District’s financial statements are presented fairly, in all material respects, and are compliant with generally accepted accounting principles (GAAP).

Annual Comprehensive Financial Reports for current and past years are available on the district’s website at this link.

Also, the district must undergo an efficiency audit prior to the tax ratification election. The district’s financial auditor, Whitley Penn, is in the process of conducting the efficiency audit. The audit will be posted in October, prior to the November election.

The results of the audit for the 2022 VATRE are available on the district’s website at this link.

Finally, even though the District cut its budget by $40M over the past two years, we have issued a request for proposal to find a firm that can help us by conducting a Cost Savings Audit. Engendering trust from District stakeholders is essential for success not just for the VATRE and a future second election, but also for the sake of students and staff. -

I have heard that FBISD is heavy at the top with administration. Is this true?

FBISD is the largest employer in Fort Bend County, employing about 13,000 people. In the 2023-24 budget, administration (function 41) accounts for $18.7 million or 2.4% of the district’s budget. This is in line with other school districts and large employers.

Administration consists of several departments, including Payroll, Accounts Payable, Accounting, Budget, Treasury, Finance, Human Resources, Communications, Police, Legal Services, Purchasing, Risk Management, Superintendent.

FBISD Programs, Enrollment, and Attendance

-

You mentioned that new programs have contributed to the financial situation. What new programs and positions have been added?

All recommendations done by the prior administration and approved by the Board at that time were done with the best of intentions. Initiatives and programs were planned and implemented by staff with the best interest of the students and employees in mind. Now, with the benefit of hindsight, it is not practical to quickly reverse past decisions about programs since we have many students now enrolled in these programs and it would be disruptive to student success to eliminate them. Until 2021-22, enrollment growth and in-district revenue were sufficient for Fort Bend ISD to continue the programs without asking voters to approve more funding to help support them.

-

Are the new programs being evaluated for effectiveness?

Yes, the district is evaluating each of the programs to ensure student growth demonstrated through test scores and academic results. The district will engage stakeholders to evaluate the effectiveness of the programs.

Of the programs that were initiated, teacher planning time at high schools and the EDGE program have both been discontinued and are included as part of the $40M in savings the district has implemented over the last two years. -

“Under-utilized campuses” and “Low utilization of campuses” were listed as one of the causes of the district’s financial problems. What does that mean?

Fort Bend ISD maintained a neighborhood school concept until 2013. Neighborhood schools are smaller than schools built since 2014. Many of these smaller schools now have low populations due to shifting demographics and are now underutilized – meaning student populations are lower than the number of children who could be taught at the campus. Our average campus size is about 800 students per school, but this includes high schools and middle schools. Our peer districts have average campus sizes over 1,200 (Katy ISD & Cy Fair ISD).

There are fixed costs needed to operate a campus (principal, assistant principal, nurse, counselor, librarian, etc. but not teachers). Fewer students at a campus lead to higher costs per student. In districts where overall enrollment growth is high (like Lamar CISD), the impact of operating smaller campuses is mitigated. Now that FBISD’s enrollment growth has slowed, we are feeling the financial impact of smaller schools.

With the impact of inflation, and state-wide shortages of teachers, aides, police, bus drivers, etc., the District cannot maintain this cost structure long-term and keep essential staff in harder to fill positions. -

What options are there to address the low expenditure per student if the VATRE does not pass?

Locally, options to increase revenue or expenditure per student without a VATRE are extremely limited. In order for expenditure per student to grow, our revenue needs to grow concurrent with expenditures to ensure we do not have deficit spending.

To increase revenue per student without a VATRE, our total enrollment or attendance would need to increase. We have very little control over enrollment growth. Attendance can be impacted, but our attendance rate is currently at 95.93%, which is about 2% higher than the state average.

Without the VATRE, we will continue to have to cut our budget. Everything done within the last two years to cut $40M will have to be looked at again to see if we can do more or go deeper on those cuts. Other items discussed, but avoided, included increasing class sizes or making reduction to student programs of choice would be on the table. All of these options will have to be evaluated and discussed. -

What has happened with enrollment?

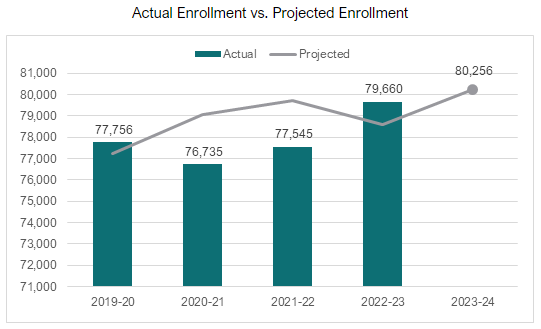

The COVID 19 pandemic had a negative impact on FBISD enrollment during the 2020-21 and 2021-22 school years, but enrollment has recovered. The numbers below reflect actual versus predicted enrollment in late October for each year. Our enrollment numbers at the end of the 2021-22 school year were back above pre-pandemic enrollment levels. For the 2023-24 school year, FBISD is expected to have enrollment of 80,256.

-

What are you doing to increase enrollment and attendance?

We have streamlined our enrollment process and amplified the importance of student attendance. Before the pandemic, our student attendance rate was at 96.5%. Last year in the 2021-22 school year, the cumulative rate of attendance was at 94.5%. Increasing the student rate of attendance by 1% would yield about $5.4 million. (Additional revenue may be generated by students who are in special populations.)

There are many advantages to staying in FBISD schools compared to attending charter or other schools. Our academic results are stronger, and we have award-winning fine arts programs and championship athletic teams. -

How many students has FBISD lost to charters?

As of October 2022, there were 5,892 students who live within Fort Bend ISD who attended charter schools.